NURIN HAMID

Professional Financial Services and Capability Development

With over a decade of experience in both the financial services and human capability development sectors, Nurin Hamid has become a sought-after trainer, speaker, and professional resource in these fields. Her contributions have led to the development of impactful training programs, thoughtfully designed to address the unique needs of various industries.

Driving Financial Solution with Purpose

Throughout her career, Nurin has supported a wide range of clients, from individuals to high-net-worth clients, by offering Shariah-compliant financial planning strategies. She provides personalized solutions that help clients manage risk, build investment portfolios, meet zakat obligations (for Muslim clients), and optimize their tax planning all aligned with their personal objectives and values.

A significant part of her work focuses on Islamic estate planning, where she assists clients in developing legacy strategies, structuring succession plans, and ensuring a smooth inheritance process. By guiding individuals in preparing essential documents such as Wasiat and Hibah, she helps reduce potential conflicts and ensures a clear path forward for beneficiaries

Nurin’s work extends beyond financial planning. She has designed and led capacity-building programs in Islamic finance and broader various skills development.

Strengthening Human Capability

Her seven years in the oil and gas industry reflect her strengths in human capital functions, including job evaluation, manpower planning, and talent development. In 2024, she was appointed as a panel member for Malaysia’s National Occupational Skills Standards (NOSS) in pre-financial planning, contributing to the development of competency frameworks across all levels. In recognition of her expertise and industry dedication, she qualified for the Malaysia Advanced Skills Diploma awarded by the Department of Skills Development under MoHR. This initiative helps create accessible entry points for individuals seeking to build foundational knowledge in financial literacy.

Professional Services & Advisory

Her passion lies in creating sustainable impact in the areas of financial planning and human development. With her well-rounded background and dedication to service, she is a trusted professional who delivers value across sectors locally and with aspirations to expand her reach globally

WHAT I DO?

TRAINER/ SPEAKER

She designed financial programs for every level of participants especially for non-financial professions, other background, students and even children. Modules’ content are aim to equip the participants with basic knowledge in financial plan with less technical but more interactive approach for participants to understand.

Islamic FAR & FPR-CMSRL

Assists clients to plan the holistic personal financial objectives by assessing financial situation; developing and presenting financial strategies and plans and monitoring changes in their financial portfolio. The plan will include assessing current financial condition to improvise and strengthen the desired future financial plan during good or bad times.

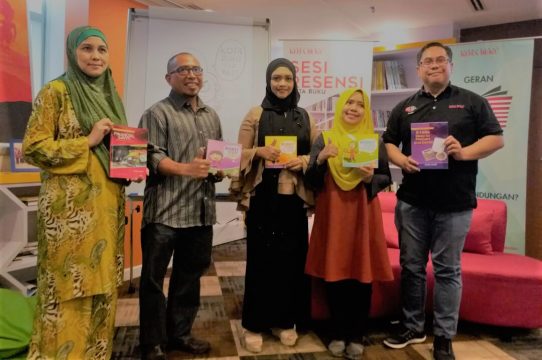

LEARNING AUTHOR / WRITER

She designed financial programs for every level of participants especially for non-financial professions, other background, students and even children. Modules’ content are aim to equip the participants with basic knowledge in financial plan with less technical but more interactive approach for participants to understand.

BOOK LISTING.

Accessible Financial Literacy Through Islamic Finance

These financial literacy books incorporated different approach in finance by instilling Islamic Financial elements. However, it has less technical method and suitable for layman references.

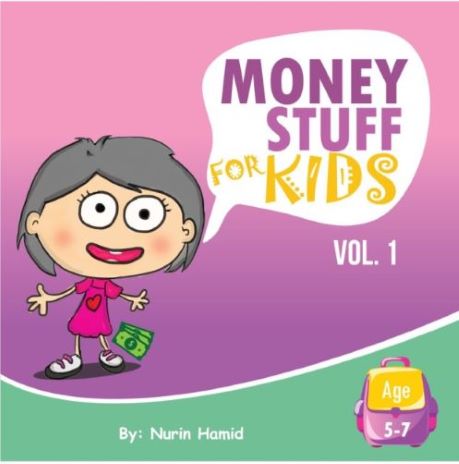

MONEY STUFF FOR KIDS (Volume 1)

This volume is an early introduction to young readers in the age of 5 to 7, about the simple definition of money and how people earn it. The content explains how money is used to buy goods and services. It also simplifies the concept between ‘needs’ and ‘wants’ that relates to money and the differences. This volume will also introduce the basic elements about spending and saving money.

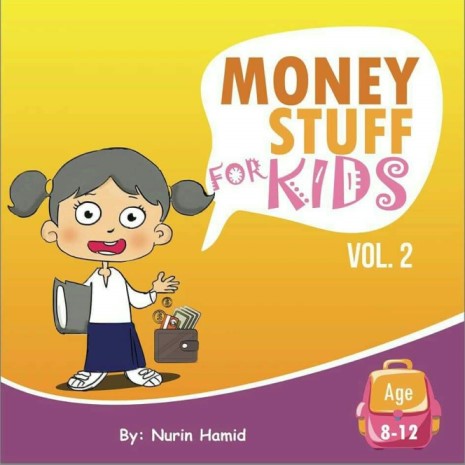

MONEY STUFF FOR KIDS (Volume 2)

This volume will be the sequel to Volume 1 of financial literacy for children age 8 to 12. It also introduces the basic concepts of saving, spending and sharing money.

This book also touches on some very basic terms in accounting. It also introduces the function of financial institutions such as banking system and elements related to them.

MONEY STUFF FOR KIDS (Volume 3)

This volume will discuss further on the financial matter how to manage it for teens age 13 to 17. In turn, they will comprehend basic economics; such as supply and demand and entrepreneurship. Thus, nurturing the entrepreneurship fundamental elements could help children to internalize enterprising skills.

FINANCIAL SAVVY: A WORTHY CYCLE

This book is expected to increase the awareness of youths about the importance of financial management in their early career life. It is suitable reading for all youth regardless religion for comparison the similarities and differences in Islamic financial way. However, what is more important the content includes holistic elements in financial plan such as understand the financial statements, understand risks, investment, income tax and zakat and also touches on investment fraud.

Financially related matter is not only meant for financial people, financial experts or those in the industry; it also contains important instruments for non-financial background young people to practically implement and be mindful of their money.

A LITTLE STEP TO HEAVEN AND EARTH

The book is a simple handbook to apply the fundamental knowledge in personal financial plans that introduce core methodology in managing personal finances. The unique approach of this personal financial plan is based on Islamic fundamental in which most elements are suitable not only for Muslims but also non-Muslims.

It has lesser technical approach with more illustrations and graphics for easy understanding to the non-financial professions and other readers with or without financial know-how. The content covers overall sub-topics in financial plan as follows:

- Basic Financial Statements

- Managing Risks

Investment and Retirement Plan - Zakat and Tax Management

- Islamic Estate Planning

In addition, the content is less technical for the Non- Financial readers to understand. Readers can design and assemble their own basic financial portfolio adapting relevant elements from the basic guidelines given. It shows practical ways to determine everyone’s own simple financial portfolio for short and long-term gains.

www.nurinhamid.com | Copywright 2024